So, we’re probably meeting here together on this webpage because you are dealing with the nightmare of overseas remittance (or sending money abroad). From long wait times to inconvenience, high fees and honestly, just not knowing what to expect, sending money home can be nerve-wracking. As the cherry on top of your anxiety sundae, Korean banking, in general, is a lot less convenient than what many Western people are used to. Why does it have to be so hard to send your mom some money for a present? Or to pay back your student loans? Or take care of an emergency?

There’s an amazing Korean Fin-tech Startup app called Sentbe that takes a lot of headache (and high fees!) out of overseas remittance.

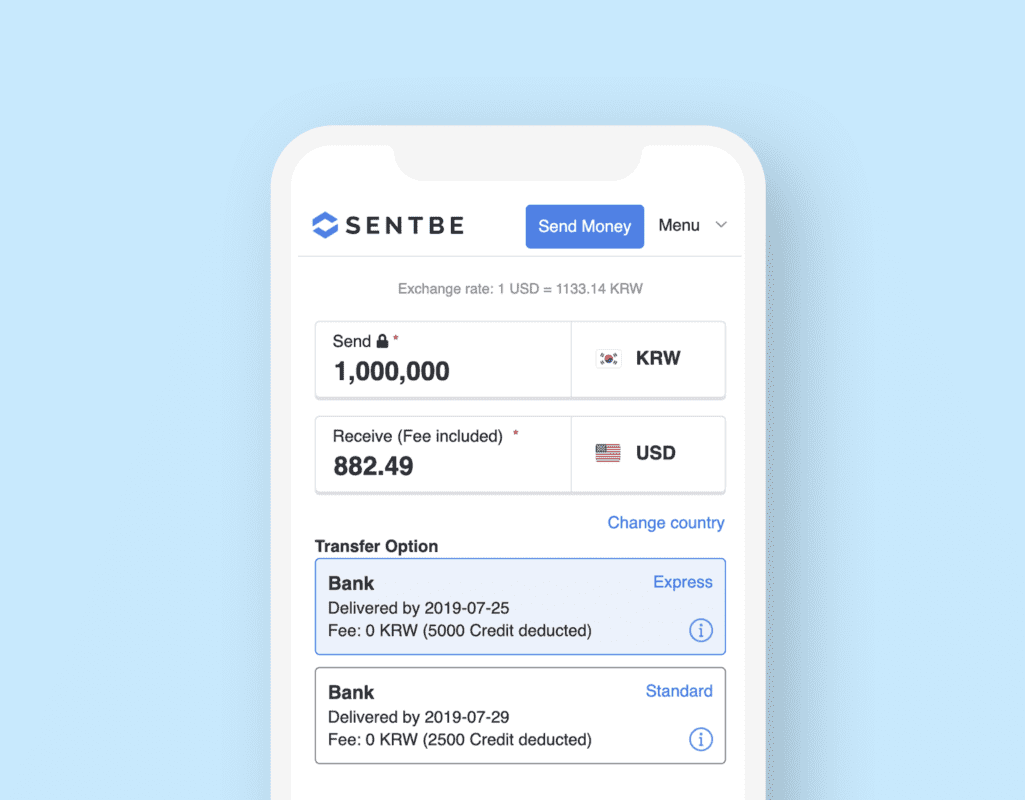

In other countries, apps like TransferWise or Western Union are widely used for overseas money transfers. Sentbe is like those applications and was created with expats in Korea in mind. Standard transfer fees are 2,500 won per transaction (2 days), and express services are 5,000 won per transaction (within one day), which is 95% lower than most bank fees. And thanks to their partnership with Ripple, transactions are faster and more secure.

Setting up and getting verified is easy peasy

If you’re already set up for mobile banking services with your Korean bank:

- Grab a glass of wine, settle down with your phone.

- Download the app

- Enter your phone number, snap a photo of a valid ID (an Alien Registration Card, Korean Drivers License or Passport) and type your Korean bank account number.

- Sentbe will send 1 KRW to your bank account with the 4-digit verification code. Enter that code back into the app.

- Close your phone, turn on Netflix and by the next day, you’ll be ready to send money.

Those who use Korean bank programs for overseas remittance can sometimes be required to make separate accounts and sign up for special services, which could take 30-60 minutes at the bank. No wine. No Netflix. No thanks.

Transfer Times

After requesting a transfer through the app and sending the money from your Korean account (via online banking, ATM transfer, or Sentbe’s auto-withdrawal function) to Sentbe, transactions take 1 business day to complete.

Is Sentbe Available In My Home Country?

Currently, Sentbe is available for people transferring money to:

- USA, Australia, Canada, UK

- Philippines, Vietnam, Indonesia, Japan, China, Thailand, Nepal, Pakistan, Bangladesh, Sri Lanka, Malaysia, Cambodia, India

You can find their English social media channels on their Sentbe Expat Facebook or Sentbe Global Instagram.

What’s The Catch?

If you’re worried about safety, rest assured that Sentbe is licensed by the Korean Government, and registered in safety insurance up to 2 billion won.

The only catch we can find: if you’re trying to send huge amounts of money, you might want to look at traditional remittance services. Korean laws limit Sentbe users to 30,000,000 won worth of transfers per year, and max 3,000,000 won per transaction (but nothing to stop you from bending the rules and submitting multiple transactions per day!). For those of us with lighter pockets, whether sending money on a regular basis or just for special occasions, I can’t recommend signing up for Sentbe enough.

This article was sponsored by Sentbe, but opinions are our own and are genuine.